Does Wv Have Property Tax . West virginia does not have an. Counties, cities, school districts and other special tax districts can levy property taxes. west virginia house bill 2526, approved during the 2023 regular session of the west virginia legislature, immediately reduces. all real and tangible personal property, with limited exceptions, is subject to property tax. As of july 1 each year, the ownership, use. if you're selling a house in west virginia, however, property taxes and other real estate taxes may factor into your closing costs. The state constitution divides property into four classes: tax rates in west virginia apply to assessed value. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's.

from www.signnow.com

The state constitution divides property into four classes: striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. As of july 1 each year, the ownership, use. West virginia does not have an. Counties, cities, school districts and other special tax districts can levy property taxes. tax rates in west virginia apply to assessed value. all real and tangible personal property, with limited exceptions, is subject to property tax. if you're selling a house in west virginia, however, property taxes and other real estate taxes may factor into your closing costs. west virginia house bill 2526, approved during the 2023 regular session of the west virginia legislature, immediately reduces.

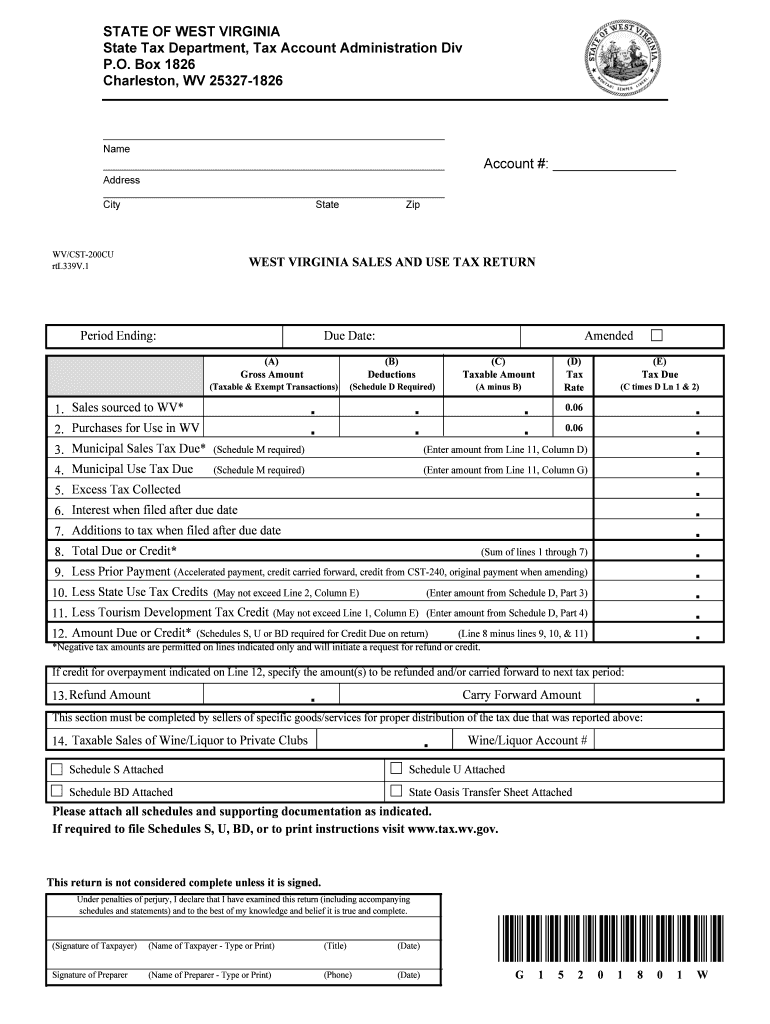

West Virginia Sales Use 20182024 Form Fill Out and Sign Printable

Does Wv Have Property Tax The state constitution divides property into four classes: The state constitution divides property into four classes: west virginia house bill 2526, approved during the 2023 regular session of the west virginia legislature, immediately reduces. Counties, cities, school districts and other special tax districts can levy property taxes. As of july 1 each year, the ownership, use. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. all real and tangible personal property, with limited exceptions, is subject to property tax. if you're selling a house in west virginia, however, property taxes and other real estate taxes may factor into your closing costs. tax rates in west virginia apply to assessed value. West virginia does not have an.

From www.alpharetta.ga.us

Property Tax Bills Mailed To Residents Does Wv Have Property Tax tax rates in west virginia apply to assessed value. if you're selling a house in west virginia, however, property taxes and other real estate taxes may factor into your closing costs. West virginia does not have an. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia. Does Wv Have Property Tax.

From www.manaycpa.com

Understanding How Property Taxes Work A Complete Guide Manay CPA Does Wv Have Property Tax all real and tangible personal property, with limited exceptions, is subject to property tax. As of july 1 each year, the ownership, use. West virginia does not have an. west virginia house bill 2526, approved during the 2023 regular session of the west virginia legislature, immediately reduces. tax rates in west virginia apply to assessed value. Web. Does Wv Have Property Tax.

From www.mortgagerater.com

Understanding WV Personal Property Tax Essentials Does Wv Have Property Tax if you're selling a house in west virginia, however, property taxes and other real estate taxes may factor into your closing costs. The state constitution divides property into four classes: striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. all real and tangible personal. Does Wv Have Property Tax.

From www.dochub.com

Wv wvnrer tax Fill out & sign online DocHub Does Wv Have Property Tax The state constitution divides property into four classes: tax rates in west virginia apply to assessed value. Counties, cities, school districts and other special tax districts can levy property taxes. West virginia does not have an. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's.. Does Wv Have Property Tax.

From www.ezhomesearch.com

EZ Home Search Guide to Virginia Property Taxes Does Wv Have Property Tax west virginia house bill 2526, approved during the 2023 regular session of the west virginia legislature, immediately reduces. West virginia does not have an. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. As of july 1 each year, the ownership, use. The state constitution. Does Wv Have Property Tax.

From wvpolicy.org

West Virginia Taxes At a Glance West Virginia Center on Budget & Policy Does Wv Have Property Tax Counties, cities, school districts and other special tax districts can levy property taxes. As of july 1 each year, the ownership, use. The state constitution divides property into four classes: all real and tangible personal property, with limited exceptions, is subject to property tax. striving to act with integrity and fairness in the administration of the tax laws. Does Wv Have Property Tax.

From www.signnow.com

Pass through Entity Prior Year Forms WV State Tax Department Fill Out Does Wv Have Property Tax all real and tangible personal property, with limited exceptions, is subject to property tax. west virginia house bill 2526, approved during the 2023 regular session of the west virginia legislature, immediately reduces. The state constitution divides property into four classes: Counties, cities, school districts and other special tax districts can levy property taxes. West virginia does not have. Does Wv Have Property Tax.

From www.mortgagerater.com

Understanding WV Personal Property Tax Essentials Does Wv Have Property Tax West virginia does not have an. The state constitution divides property into four classes: Counties, cities, school districts and other special tax districts can levy property taxes. all real and tangible personal property, with limited exceptions, is subject to property tax. As of july 1 each year, the ownership, use. striving to act with integrity and fairness in. Does Wv Have Property Tax.

From www.ezhomesearch.com

Your Guide to West Virginia Property Taxes Does Wv Have Property Tax tax rates in west virginia apply to assessed value. if you're selling a house in west virginia, however, property taxes and other real estate taxes may factor into your closing costs. all real and tangible personal property, with limited exceptions, is subject to property tax. The state constitution divides property into four classes: West virginia does not. Does Wv Have Property Tax.

From www.signnow.com

Jefferson County Personal Property Tax 20222024 Form Fill Out and Does Wv Have Property Tax tax rates in west virginia apply to assessed value. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. West virginia does not have an. west virginia house bill 2526, approved during the 2023 regular session of the west virginia legislature, immediately reduces. Counties, cities,. Does Wv Have Property Tax.

From www.nytimes.com

Where Do Property Taxes Bite (and Where Do They Nibble)? The New York Does Wv Have Property Tax tax rates in west virginia apply to assessed value. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. all real and tangible personal property, with limited exceptions, is subject to property tax. West virginia does not have an. The state constitution divides property into. Does Wv Have Property Tax.

From www.taxaudit.com

West Virginia Tax Return Change Sample 1 Does Wv Have Property Tax all real and tangible personal property, with limited exceptions, is subject to property tax. Counties, cities, school districts and other special tax districts can levy property taxes. if you're selling a house in west virginia, however, property taxes and other real estate taxes may factor into your closing costs. west virginia house bill 2526, approved during the. Does Wv Have Property Tax.

From www.uslegalforms.com

WV DoR NRSR 20122021 Fill out Tax Template Online US Legal Forms Does Wv Have Property Tax tax rates in west virginia apply to assessed value. Counties, cities, school districts and other special tax districts can levy property taxes. west virginia house bill 2526, approved during the 2023 regular session of the west virginia legislature, immediately reduces. West virginia does not have an. striving to act with integrity and fairness in the administration of. Does Wv Have Property Tax.

From www.rwhamptonroads.com

What You Need To Know About Property Taxes in Virginia Does Wv Have Property Tax The state constitution divides property into four classes: if you're selling a house in west virginia, however, property taxes and other real estate taxes may factor into your closing costs. tax rates in west virginia apply to assessed value. West virginia does not have an. Counties, cities, school districts and other special tax districts can levy property taxes.. Does Wv Have Property Tax.

From wvpolicy.org

Broad Coalition of Organizations Calls on State Leaders to Protect Does Wv Have Property Tax striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. As of july 1 each year, the ownership, use. west virginia house bill 2526, approved during the 2023 regular session of the west virginia legislature, immediately reduces. West virginia does not have an. tax rates. Does Wv Have Property Tax.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners Does Wv Have Property Tax West virginia does not have an. if you're selling a house in west virginia, however, property taxes and other real estate taxes may factor into your closing costs. Counties, cities, school districts and other special tax districts can levy property taxes. As of july 1 each year, the ownership, use. The state constitution divides property into four classes: Web. Does Wv Have Property Tax.

From blnnews.com

Property Taxes Due today BlnNews Does Wv Have Property Tax West virginia does not have an. all real and tangible personal property, with limited exceptions, is subject to property tax. As of july 1 each year, the ownership, use. striving to act with integrity and fairness in the administration of the tax laws of west virginia, the west virginia tax division's. tax rates in west virginia apply. Does Wv Have Property Tax.

From www.mortgagerater.com

Understanding WV Personal Property Tax Essentials Does Wv Have Property Tax all real and tangible personal property, with limited exceptions, is subject to property tax. As of july 1 each year, the ownership, use. West virginia does not have an. The state constitution divides property into four classes: tax rates in west virginia apply to assessed value. Counties, cities, school districts and other special tax districts can levy property. Does Wv Have Property Tax.